2026 isn’t just “another year of payments innovation.”

It’s the year payments fully graduate from plumbing to powerhouse, no longer background infrastructure, but a core driver of conversion, retention, and smarter growth.

Digital payments already rewired commerce. Over the past decade, they’ve moved from a minority of global ecommerce value to the dominant form of payment worldwide.

The next wave is less about digitisation and more about speed, choice, intelligence, and global reach.

Here are the five payment trends shaping 2026, and what they practically mean for merchants who want to stay competitive.

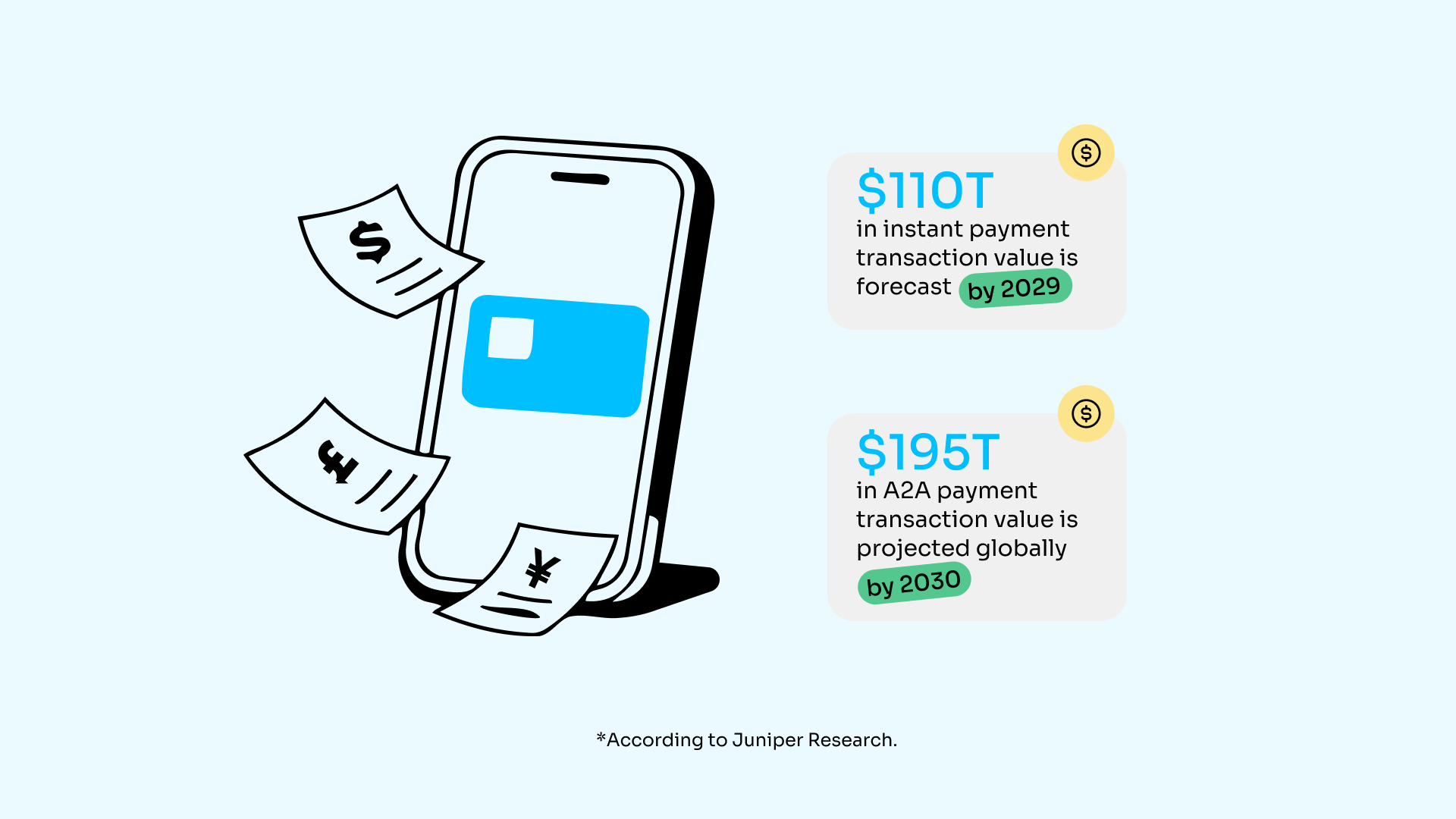

1) From fast to instant: Real-time payments go mainstream

Real-time payments are no longer a differentiator. They’re becoming the baseline.

As instant payment rails expand globally, expectations are shifting just as fast. Customers increasingly expect money to move immediately, not just authorisation, but settlement itself.

Why this matters in 2026

Fast checkout is no longer enough. Merchants are now judged on how quickly funds arrive, how clearly cashflow is visible, and how much friction exists after the transaction.

Real-time rails also unlock new experiences at the moment of payment: instant cashback, live rewards, real-time risk checks, and dynamic incentives triggered as money moves.

What smart merchants do differently

They design around immediacy, not batch cycles, using real-time payments as a foundation rather than a feature.

Hello Clever lens 💙

Real-time isn’t just about speed. It’s what allows payments to move money and growth at the same time.

2) Payment choice becomes a conversion advantage

By 2026, “card-only” checkout increasingly signals friction.

Digital wallets and alternative payment methods continue to gain share across regions, and the rule is simple: if customers can’t pay the way they prefer, conversion suffers.

Why this matters in 2026

Payment choice now directly impacts approval rates, checkout completion, and cost efficiency, especially for merchants operating across multiple markets.

What smart merchants do differently.

- Offer local payment methods by market, not just global defaults

- Remove unnecessary checkout steps

- Route transactions intelligently to balance approvals and cost

Hello Clever lens 💙

The future isn’t cards versus wallets versus A2A.

It’s one integration that unlocks global, local payment choice — with conversion and retention built in.

3) AI enters checkout: from fraud tool to agentic commerce

In 2026, AI moves out of the background.

Instead of being limited to fraud detection or reporting, AI increasingly shapes how customers discover, decide, and complete purchases, while helping merchants optimise performance in real time.

This shift is often described as agentic commerce: AI that actively guides decisions, applies incentives, and optimises outcomes at the moment a transaction happens.

What changes in 2026

- Shopping journeys compress as AI reduces decision friction

- Checkout becomes quieter and faster through embedded authentication and stored credentials.

- Merchants rely on AI to: personalise incentives, detect anomalies and risk and forecast performance and identify growth opportunities.

Why this matters in 2026

AI stops being a cost-control layer and starts influencing revenue, retention, and lifetime value — directly inside the transaction flow.

Hello Clever lens 💙

This is where payments become a growth engine: when every transaction creates insight, and every insight drives action.

4) Stablecoins grow up: from speculation to settlement

The conversation around digital assets changes in 2026.

Less speculation. More focus on practical settlement — particularly for cross-border commerce, where speed, cost, and visibility remain persistent challenges.

Tokenised settlement models and cross-border payment modernisation efforts point toward a future with fewer intermediaries and clearer money movement.

Why this matters in 2026

Cross-border payments remain one of the biggest friction points for global merchants:

- slower settlement

- higher fees

- limited transparency

Emerging settlement approaches hint at faster clearing, reduced complexity, and improved visibility — even if adoption remains uneven.

Hello Clever lens 💙

Cross-border shouldn’t feel like legacy infrastructure. The direction is clear: global money movement that feels as immediate as local.

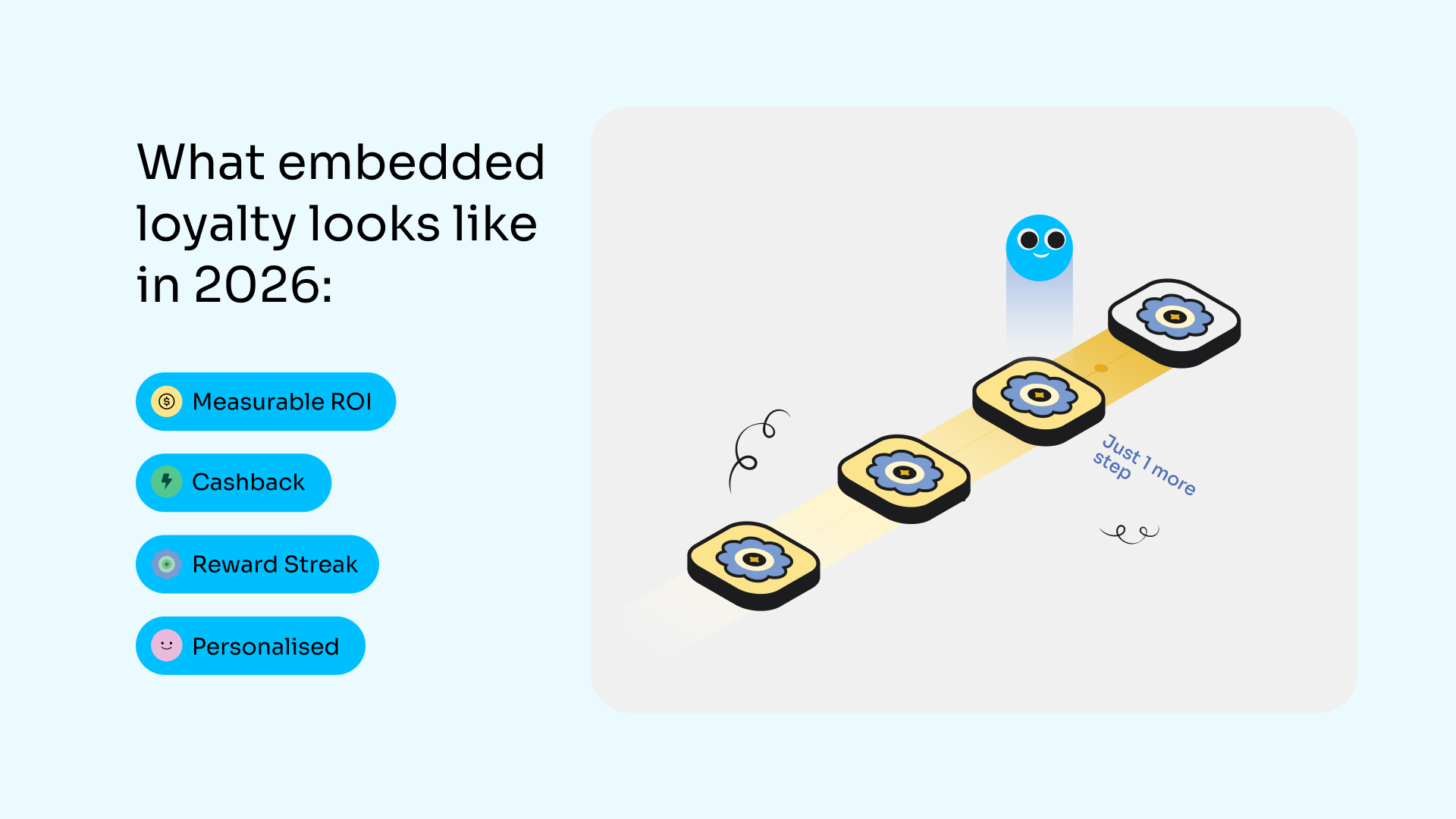

5) Loyalty moves into the transaction

Loyalty expectations are shifting and traditional programs are struggling to keep up.

Delayed points and disconnected programs feel increasingly out of step with how people spend. Payments, by contrast, offer the perfect moment to deliver relevance and value.

What embedded loyalty looks like in 2026

- Instant Cashback applied at checkout

- Milestone and streak rewards that reinforce repeat behaviour

- Personalised incentives triggered by transaction patterns

- Measurement tied to outcomes, not guesswork

Why this matters in 2026

When loyalty lives inside the transaction, it becomes timely, measurable, and directly linked to spend, not a separate system hoping to influence behaviour later.

Hello Clever lens 💙

Payments aren’t just about processing. They’re about helping merchants grow.

The 2026 takeaway: payments are growth infrastructure

Payments already operate at enormous scale, which is exactly why this next phase matters.

The winners in 2026 won’t be the merchants chasing the lowest processing rate. They’ll be the ones building payment systems that are:

Fast. Flexible. Intelligent. Global. Built for growth.

If you’re building for 2026:

✅ Design for real-time rails.

✅ Offer meaningful payment choice.

✅ Let AI handle complexity.

✅ Plan for cross-border from day one.

✅ Embed loyalty where it matters most, inside the transaction.

It pays to be clever. 💙

Leave a Reply