The global payments industry is projected to surpass $3 trillion in revenues by 2025, with digital payments accounting for an overwhelming majority of transactions. As consumer expectations evolve, 80% of shoppers now prioritise convenience and security in their payment methods, while 70% actively seek out platforms offering personalised rewards. At Hello Clever, we’re dedicated to empowering businesses and delighting consumers by staying ahead of these trends. Hello Clever is uniquely positioned to lead the charge in reshaping how people engage with payments. Here are the top payment trends we believe will define 2025:

1. Real-Time Payments (RTPs) Becoming the Norm

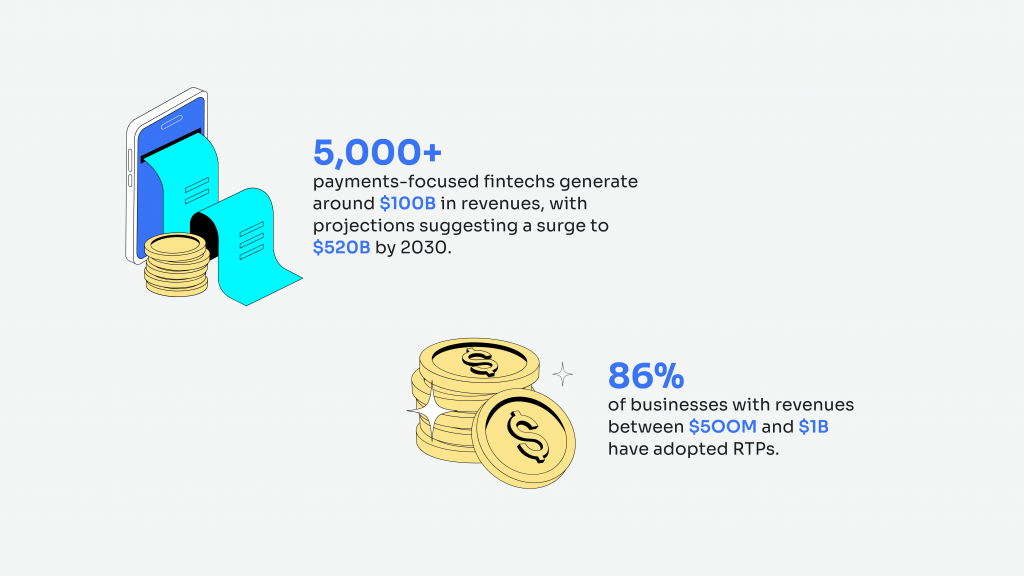

The demand for speed and efficiency has cemented real-time payments as a staple in global commerce. Research from Capgemini’s World Payments Report 2025 indicates instant payments are set to grow from 16% of global payment transaction volume in 2023 to 22% in 2028. Instant A2A payments could offset 15-25% of future card transaction volume growth.

In 2025, we expect wider adoption across industries as businesses recognise the value of instant transactions for enhancing cash flow and improving customer satisfaction. Hello Clever’s instant cashback platform is at the forefront of this trend, providing users with rewards they can spend immediately, creating a seamless and gratifying shopping experience.

RTPs are becoming a key driver for economic growth, with 86% of businesses with revenues between $500 million and $1 billion already adopting this efficient transaction method. These instant payments enhance liquidity and financial stability by unlocking working capital and reducing transaction times. They also help integrate informal economic activities into the formal financial system.

2. Embedded Finance Redefining Experiences

Embedded finance—the integration of financial services into non-financial platforms—is set to grow exponentially. From e-commerce sites offering one-click financing to apps with built-in payment capabilities, the convenience factor is unparalleled. Hello Clever’s embedded API enables partners to integrate rewards directly into their platforms, fostering customer loyalty and driving repeat engagement.

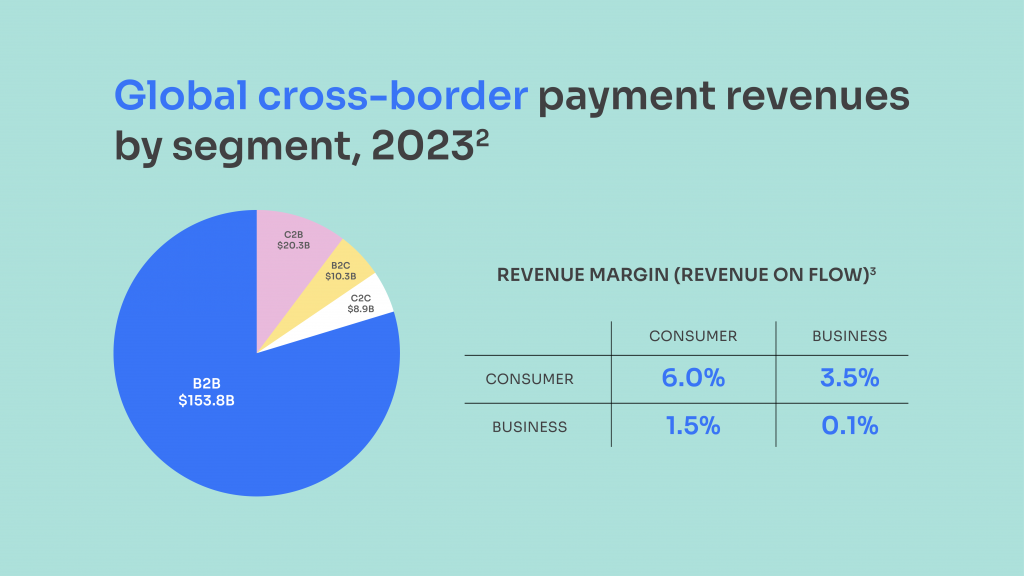

3. Cross-Border Payments Simplified

A key finding is a surge in cross-border payment flows, anticipated to reach $290 trillion by 2030. This growth in cross-border payments is fuelled by the rise of international e-commerce, globalised workforce mobility, and transformative digital payment solutions that make sending money faster, easier and more transparent. The sector’s rapid growth highlights the pivotal role of advancing technology to support the opportunities, and challenges, that arise from such volume.

Global commerce is booming, and with it comes the need for frictionless cross-border payment solutions. In 2025, we anticipate significant strides in making international transactions faster, cheaper, and more accessible. Partnerships like ours with WorldFirst showcase the potential of collaborative efforts to redefine global trade and enable businesses to expand their horizons.

4. AI and Machine Learning Enhancing Personalisation

GENERATIVE AI HAS CAUGHT THE ATTENTION OF PAYMENTS COMPANIES

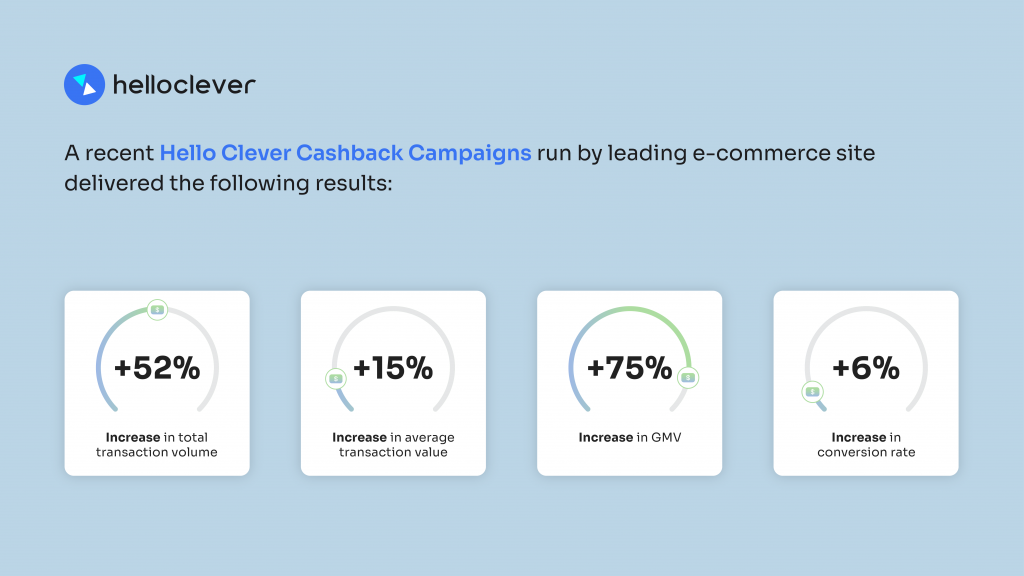

AI and machine learning are becoming integral to delivering personalised payment experiences. From tailored cashback offers through our “Cashback Campaigns’ to predictive analytics that optimise spending, these technologies are reshaping customer engagement. Hello Clever harnesses AI to provide insights and rewards that resonate with individual users, creating meaningful connections.

5. Customer-Centric Loyalty Programs

Generic loyalty programs are being replaced by hyper-personalised, data-driven initiatives that offer real value. Rewards need to reflect the preferences and behaviours of today’s discerning consumers. Hello Clever’s instant cashback program takes this a step further by offering real-time, no-hassle rewards that are directly applicable to users’ spending habits.

In 2025, successful loyalty programs will combine ease of use with relevance. Think tailored offers, dynamic rewards based on real-time analytics, and cross-platform compatibility. At Hello Clever, we’re doubling down on creating loyalty mechanisms that feel intuitive and deliver genuine value, ensuring our users remain engaged and delighted.

Moreover, our partnerships empower businesses to use loyalty as a strategic growth tool. By integrating our white-label cashback API, businesses can create bespoke rewards programs that not only attract but also retain customers, driving higher lifetime value and fostering deeper connections.

Leave a Reply