In July 2026, card surcharges will be a thing of the past, following a year of industry consultation. The Reform is expected to return over $1.2 billion to Australian consumers annually.

But this isn’t just a win for shoppers.

It’s a wake-up call for merchants.

And a massive tailwind for platforms like Hello Clever, built for what’s next.

What’s Changing and Why It Matters

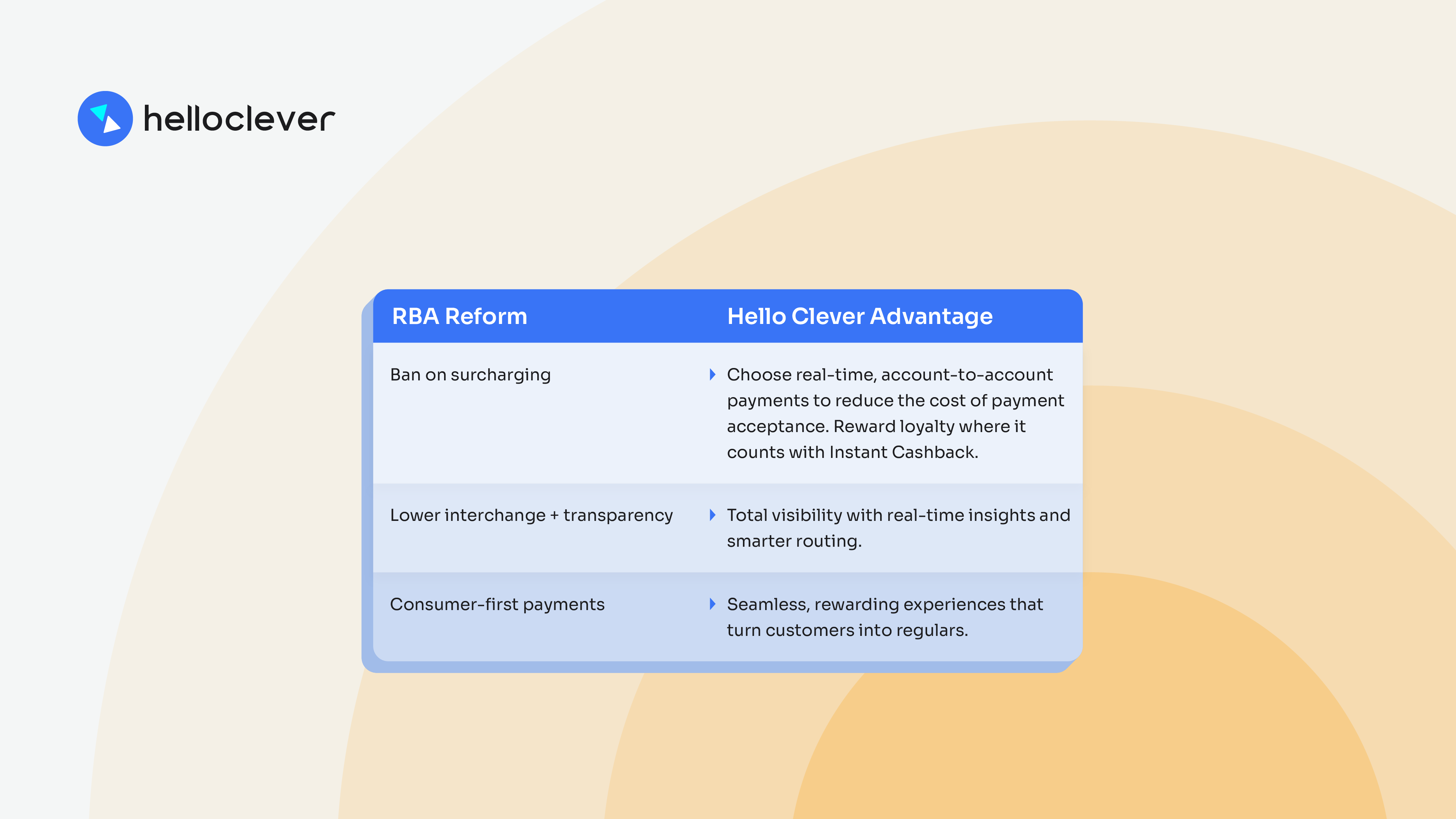

The RBA is moving fast on three big fronts:

✅Ban on card surcharges: Every listed price becomes the actual price paid by customers.

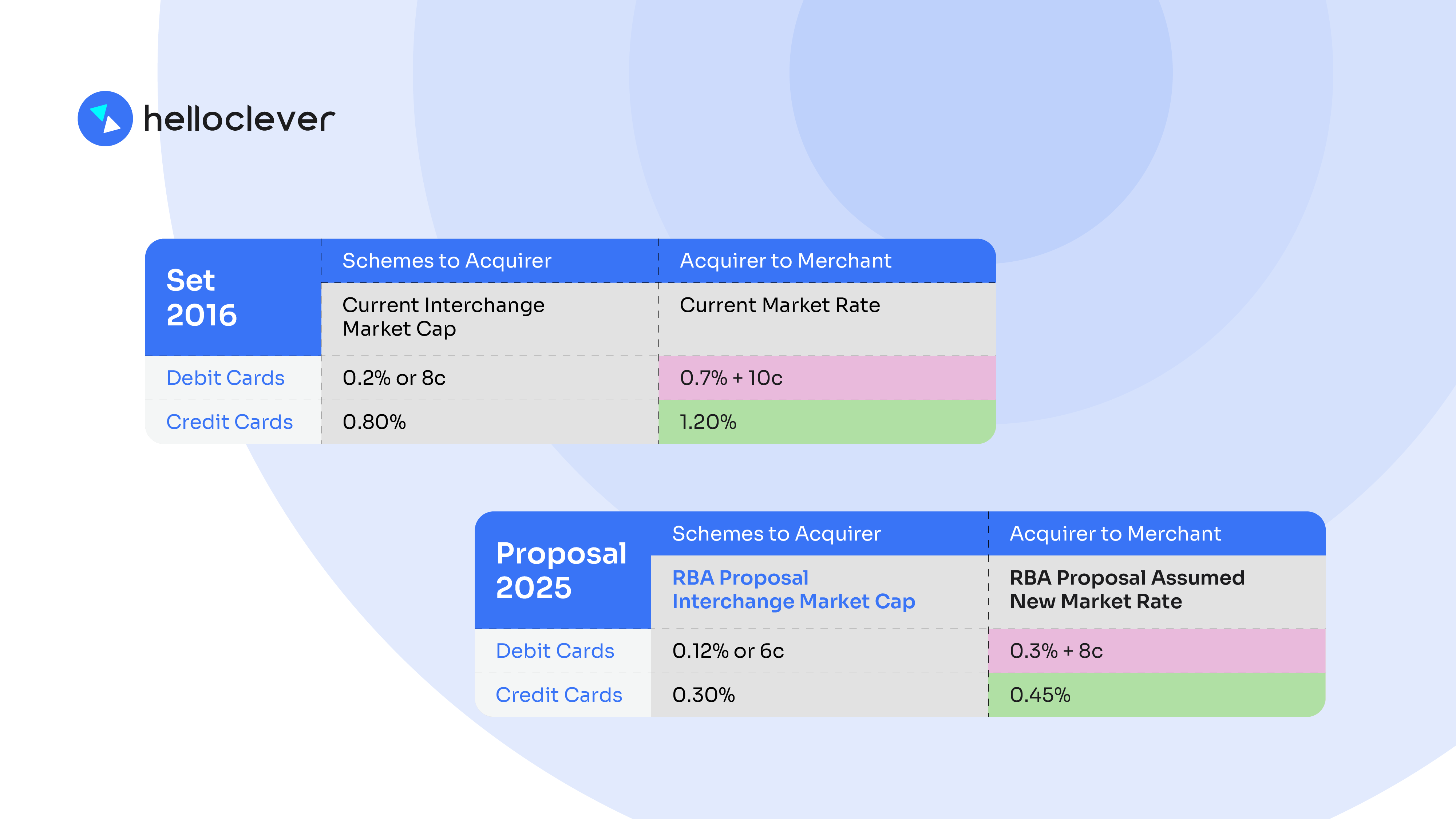

✅Reduced interchange fee caps: Less skim off the top for card schemes.

✅Mandatory fee transparency: Providers must show their hand.

What this means for merchants and consumers

Consumers win

When surcharges disappear, so do the last-minute checkout surprises. Shoppers pay what they see and trust grows in the process.

Merchants feel the squeeze

No more adding on processing fees. Merchants will need to bake these costs into their pricing or find smarter ways to protect their margin.

Visibility becomes the new battleground

With fee disclosures now mandatory and interchange caps tightening, merchants get a clear view of what they’re really paying. It becomes easier to see which platforms deliver value and which ones don’t.

Why Hello Clever Wins in a No-Surcharge World

🚀 This isn’t a headache. It’s a reset button. And Hello Clever was built for it.

1. Built on Real-Time Rails

When you can’t charge more, you should have the option to pay less.

Hello Clever’s real-time, account-to-account payment infrastructure costs less than typical card fees and speeds up cash flow, without compromising the customer experience.

2. Cashback That Converts

Surcharges are out. Instant Cashback is in.

Hello Clever lets merchants offer Instant Cashback directly at the point of purchase. It’s not just a nice-to-have, it’s a proven loyalty engine. Customers come back. Conversion goes up, and you never have to sneak in a fee to stay profitable.

3. Smarter Data, Better Decisions

Most payment processors give you backward-looking reports. Hello Clever gives you real-time insights.

Our Clever AI translates transaction data into insights merchants can actually act on. From spending trends to predictive offers, all surfaced in the moment, not the month after.

4. Built for Performance, Not Just Processing

For years, legacy providers got away with basic tools and hidden fees.

With the RBA reforms, that era is over.

Merchants are demanding more from every transaction and Hello Clever delivers.

Hello Clever: A Strategic Fit for Australia’s New Payments World

With Hello Clever, payments aren’t a cost centre.

They’re your next growth engine.

Leave a Reply