Tag: Hello Clever

-

Clever Updates: From Licence to Lift Off.

This month’s update is about momentum. The kind that builds quietly and then all at once. From new cities to new licences and a smoother merchant dashboard, every update in this edition moves us closer to one goal: a stronger, faster, more connected Hello Clever. Here’s what’s inside: ✅ Elevate goes global: Bringing our biggest…

-

More Yes in Payments: Hello Clever Levels Up with PayFac Status.

Picture this: a customer is ready to buy, card in hand, funds in the bank. They tap, but instead of a simple yes, the screen flashes declined. It’s more than just an awkward moment. It’s a sale lost, a customer gone, and trust broken. These moments are more common than most realise, and they quietly…

-

Clever Product Updates: Smarter Systems. Smoother Growth.

Smarter Systems. Smoother Growth. Every edition we release updates that make our platform sharper, not just for merchants, but also for the teams and systems behind the scenes. This September brings three key upgrades: Some of these changes you’ll spot right away. Others run quietly under the hood, like upgrading the engine while you’re driving.…

-

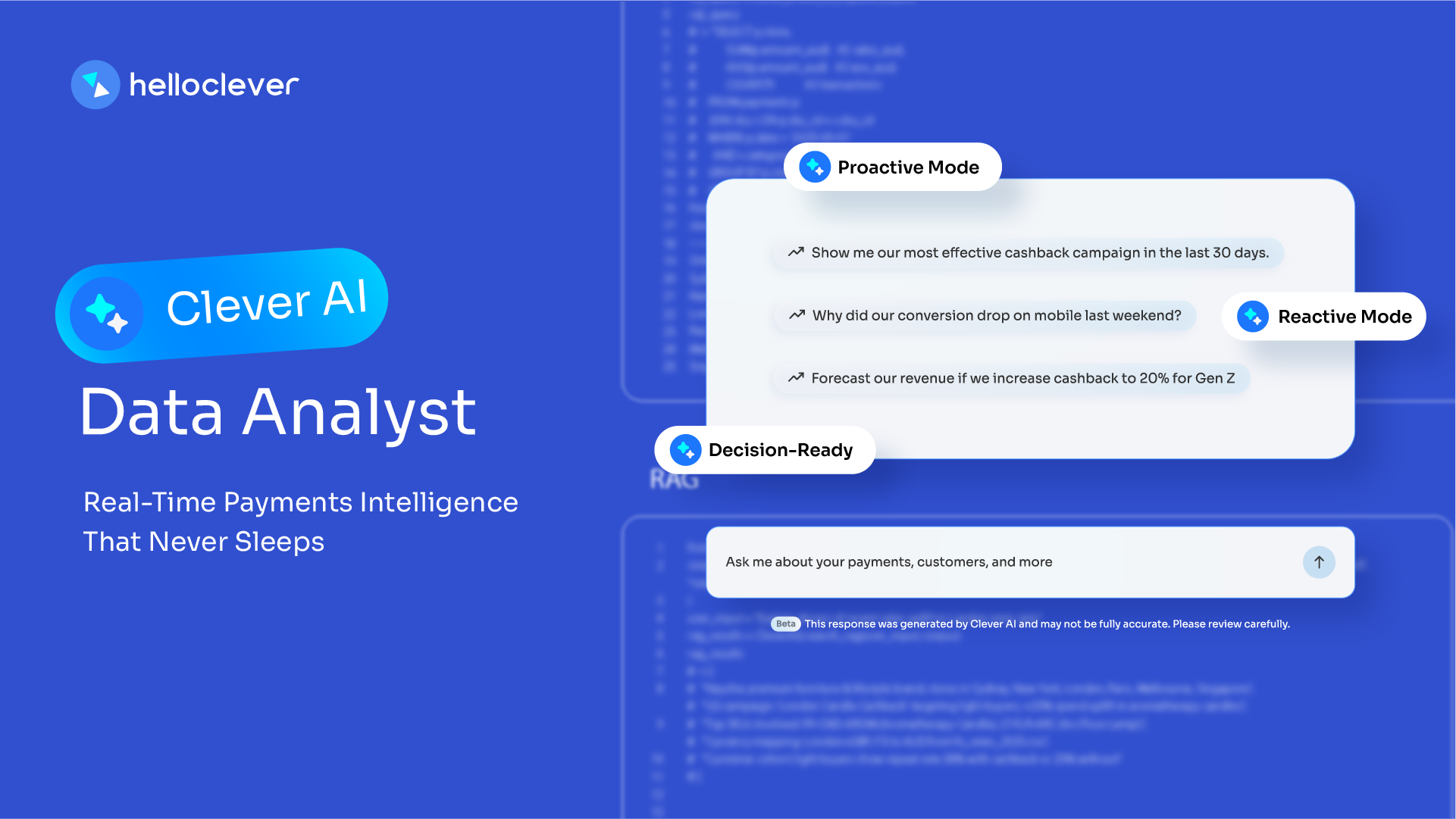

Clever AI Data Analyst: Real-Time Payments Intelligence That Never Sleeps.

Discover Clever AI Data Analyst, part of Hello Clever’s payments & loyalty intelligence platform. Real-time answers, proactive alerts, and predictive forecasts. PCI Level 1 secure.

-

Sydney to Tokyo: Hello Clever Expands to Japan

We’ve officially opened our doors in Japan. Led by Kaido Chiwata, Hello Clever’s expansion brings real-time payments, loyalty intelligence, and AI-powered insights to one of the world’s most advanced markets, with local roots and global reach.

-

Clever Product Updates: Invisible Tech. Visible Impact.

This month, Hello Clever introduces three powerful updates designed to drive smarter growth with less effort. From an intelligent loyalty engine that builds habits, to faster integrations, and branded checkout experiences. It’s all about giving merchants the tools to convert, retain, and scale.

-

Rethink the Playbook: Merchant Intelligence, Powered by Clever AI Forecaster.

In a world of promotions, peaks, and unpredictable demand, sticking to what’s familiar can feel safer than trying something new, even if the data says otherwise. That’s why we built Clever AI to help merchants break free from the old playbook and explore what their data is really capable of. What should I offer? When…

-

Clever Product Updates: Smarter. Sharper. Better Insights.

This month’s Clever Product update is all about putting powerful tools in your hands—from smarter decision-making to simpler campaign setup. And at the heart of it all is Clever AI, our most powerful launch yet. Let’s get into it. Supercharge Your Business With Clever AI The data analyst you didn’t think you could afford. Now built…

-

Instant Cashback: The Modern Perk That’s Redefining Customer Rewards.

In today’s fast-paced digital landscape, consumers expect instant gratification in all aspects of their lives, including loyalty programs. Gone are the days of waiting weeks or months for rewards to accumulate or be redeemed. With the advent of real-time payments, consumers are demanding instant loyalty, and businesses must adapt to meet this new expectation. The…

-

Hello Clever Welcomes Lakun Agrawal as New CFO.

Sydney, Australia – August 2024 – Hello Clever, proudly announces the appointment of Lakun Agrawal as Chief Financial Officer (CFO), effective immediately. Lakun brings over 25 years of experience in strategic financial management and commercial operations across a diverse range of industries, including marketing, telecommunications, and research. His career is marked by significant achievements driving…